Comprehensive Guide to Starting a Transport Company in Switzerland

Switzerland is renowned for its efficient transport network and strategic position in Europe, making it a prime location for launching a transport company. However, establishing a transport business in Switzerland requires navigating a unique regulatory landscape shaped by its non-EU status, environmental policies, and strict compliance standards. This guide provides an extensive overview of the steps and obligations to start a transport company in Switzerland.

Switzerland is renowned for its efficient transport network and strategic position in Europe, making it a prime location for launching a transport company. However, establishing a transport business in Switzerland requires navigating a unique regulatory landscape shaped by its non-EU status, environmental policies, and strict compliance standards. This guide provides an extensive overview of the steps and obligations to start a transport company in Switzerland.

Business Registration and Selecting a Business Structure

Choose the legal structure that best fits your business goals and liability preferences:

- Sole Proprietorship (Einzelfirma):

- Ideal for small businesses, with simple registration but unlimited personal liability. Einzelunternehmen

- Limited Liability Company (GmbH):

- Popular for medium businesses, offering limited liability and flexibility. Gesellschaft mit beschränkter Haftung (GmbH)

- Corporation (AG):

- Suitable for larger companies with significant operations and shareholders. Aktiengesellschaft AG

Business Registration Process

- Commercial Register:

-

Register your business with the Swiss Commercial Register (Handelsregister) for legal recognition. Handelsregisterämter der Schweiz

Register your business with the Swiss Commercial Register (Handelsregister) for legal recognition. Handelsregisterämter der Schweiz

- Tax Identification Number:

-

Register with the Swiss Federal Tax Administration (FTA) for a VAT identification number if your annual turnover exceeds CHF 100,000. Mehrwertsteuer online anmelden

Register with the Swiss Federal Tax Administration (FTA) for a VAT identification number if your annual turnover exceeds CHF 100,000. Mehrwertsteuer online anmelden

- Cantonal Permits:

- Obtain necessary permits from the canton where your business is based.

Licensing and Permits

- National Transport License

-

A transport company operating in Switzerland must obtain a Swiss National Transport Permit from the Federal Office of Transport (FOT). This permit is necessary for domestic transport activities. Lizenz für Strassentransport

A transport company operating in Switzerland must obtain a Swiss National Transport Permit from the Federal Office of Transport (FOT). This permit is necessary for domestic transport activities. Lizenz für Strassentransport

- International Transport License

- To transport goods across borders, apply for an ECMT (European Conference of Ministers of Transport) license, even though Switzerland is not an EU member. CEMT-Genehmigungen

Licensing Requirements

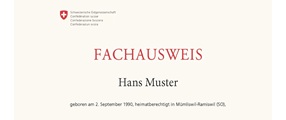

- Professional Competence:

-

The transport manager must hold a Certificate of Professional Competence (CPC). Fachausweis Transport

The transport manager must hold a Certificate of Professional Competence (CPC). Fachausweis Transport

- Financial Standing:

- Demonstrate sufficient financial resources to sustain operations (minimum CHF 9,000 for the first vehicle, CHF 5,000 for additional vehicles).

- Good Repute:

- Provide evidence of a clean criminal and financial record for key personnel.

Vehicle Registration and Compliance

- Vehicle Registration

-

Register all vehicles with the Strassenverkehrsamt (Swiss Road Traffic Office) in the canton of operation. Submit proof of ownership, insurance, and compliance with technical standards. Adressen der Strassenverkehrsämter

Register all vehicles with the Strassenverkehrsamt (Swiss Road Traffic Office) in the canton of operation. Submit proof of ownership, insurance, and compliance with technical standards. Adressen der Strassenverkehrsämter

- Technical Inspections

- Vehicles must undergo periodic technical inspections to ensure roadworthiness and safety. Heavy goods vehicles (HGVs) are subject to stricter and more frequent inspections. Fahrzeugprüfung MFK

- Environmental Standards

- Vehicles must meet Euro 6 emission standards. Some Swiss regions enforce low-emission zones, requiring vehicles to comply with environmental restrictions.

Insurance Requirements

- Mandatory Insurance

- Civil Liability Insurance: Covers damages caused to third parties. Vehicle Insurance: Protects against accidents and damages involving company vehicles. Cargo Insurance: Ensures protection of goods during transit.

- Additional Coverage

- Employer Liability Insurance: Mandatory for businesses with employees. Business Liability Insurance: Protects against operational risks.

Employment and Labor Regulations

- Hiring Drivers

-

Drivers must hold a valid Category C or CE driver’s license for heavy vehicles. They are also required to complete a Driver Certificate of Professional Competence (CPC), renewed every five years. CZV - Fähigkeitsausweis - Ausweis 95

Drivers must hold a valid Category C or CE driver’s license for heavy vehicles. They are also required to complete a Driver Certificate of Professional Competence (CPC), renewed every five years. CZV - Fähigkeitsausweis - Ausweis 95

- Labor Compliance

-

Register employees with the Swiss Social Insurance System for pension, health, and accident coverage. Comply with Swiss labor laws governing working hours, wages, and employee benefits. Anmeldung von Arbeitnehmern

Register employees with the Swiss Social Insurance System for pension, health, and accident coverage. Comply with Swiss labor laws governing working hours, wages, and employee benefits. Anmeldung von Arbeitnehmern

- Driving Hours and Rest Periods

- Follow EU Regulation (EC) No 561/2006, which Switzerland aligns with through bilateral agreements, for driving and rest times. Vehicles must have tachographs installed to monitor compliance. Driving time and rest periods in the road transport sector

Taxation and Financial Obligations

- Corporate Taxes

- Switzerland has a canton-specific tax system, with corporate income tax rates ranging from 11.9% to 21% depending on the location. VAT (Value Added Tax) is set at a standard rate of 7.7%, lower than most EU countries.

- Road Taxes and Charges

- HGVs are subject to the Heavy Vehicle Fee (HVF), calculated based on vehicle weight, emissions, and kilometers driven. Tolls may apply for using specific routes or tunnels, like the Gotthard Tunnel. Pauschale Schwerverkehrsabgabe (PSVA) für Schweizer Fahrzeuge

Environmental Obligations

- Low Emission Zones (LEZs)

- Major cities like Zurich and Geneva enforce restrictions on older, polluting vehicles. Compliance may require retrofitting or the use of alternative fuel vehicles. Die Umweltplakette

- Eco-Friendly Incentives

- The Swiss government offers subsidies for electric and hybrid vehicles. Businesses adopting sustainable practices can benefit from tax deductions and grants.

Operational Standards and Safety Compliance

- Cargo Safety

- Ensure compliance with load securing standards to prevent accidents and protect goods. Vehicles must carry mandatory safety equipment, including reflective signs and fire extinguishers.

- Health and Safety

- Implement workplace safety measures, particularly for loading and unloading. Conduct regular training sessions for employees on safety practices.

- Documentation

- Maintain detailed operational records, including vehicle maintenance logs, driver activity, and financial transactions.

Digital and Innovative Practices

- Fleet Management Tools

- Use GPS and digital software to optimize routes, reduce fuel consumption, and monitor vehicle performance.

- Sustainability in Logistics

- Adopt eco-friendly technologies, such as electric vehicles or biofuels, to meet Switzerland’s sustainability goals.

Inspections and Penalties

- Regulatory Inspections

- The Federal Office of Transport and cantonal authorities conduct regular inspections to ensure compliance with transport regulations. Bundesamt für Verkehr BAV

- Consequences for Non-Compliance

- Violations can result in fines, suspension of licenses, or business closure.

Conclusion

Starting a transport company in Switzerland offers significant opportunities in a highly developed market, but it also requires strict compliance with national and international regulations. By ensuring adherence to licensing requirements, vehicle standards, labor laws, and environmental policies, you can establish a successful and sustainable transport business. Leveraging digital tools and eco-friendly technologies will further enhance your competitive advantage in this dynamic industry.

eXus Dev